Laurie P.

Blog Summary

This blog delves into how brands can enhance customer trust and loyalty by leveraging genuine consumer insights to refine their messaging and marketing strategies.

Key Points Overview

Top Takeaways

Conclusion

Understanding and utilizing consumer insights allows brands to not just react to market changes, but anticipate and adapt to them, ensuring relevance and strengthening customer relationships in a highly competitive environment.

Consumers have many brand options these days, which helps explain why brand loyalty is at an all-time low. And to compound that issue, people trust what others say on the internet more than they trust a brand’s marketing message. That being the case, marketers have to work extra hard to build trust with consumers while building a relevant brand image through their messaging.

At face value, brands appear to have their hands tied from the beginning. It may take time to get good traction. Still, a messaging strategy built around trustworthy consumer insights is how top brands build communities, generate UGC, and leave their audiences feeling entertained and better informed.

What do we mean by consumer insights? We’ll get into that in-depth here but suffice it to say it goes far beyond your sales figures and how many 5-star reviews you have. Data analytics provides the ability to capture a 360-degree, multi-dimensional viewpoint of your target audience. And once you know your audience inside-out, you can craft precise messaging to speak to the issues most pressing to you and your customers.

Here, we’ll take a deep dive into the voice of the customer and show how a holistic consumer perspective enables surgical precision in your marketing. Specifically, we’ll cover:

Consumer statistics are a survey of how behaviors are playing out in the marketplace. Even if your brand is on the right side of them, consumer insights into your audience will help you adjust and capture even more share of voice.

Here are a few recent examples of how consumer behavior is playing out:

Each of these stats are nuggets of intel your brand could potentially strategize around. But your brand is much better off with actionable consumer insights to help you shape your decisions. Let’s jump into the basics and build out from there, so you know what options are available to you and how to turn insight into action!

These two terms are used interchangeably––however, they are two very different tools. They both provide indispensable data that inform better business decisions. Here’s how they vary.

This type of research focuses on the market as a whole. And it can include valuable qualitative and quantitative data found in focus groups, interviews, product testing, surveys, etc. This intel reveals how your audience perceives the industry and your brand or products.

Now, consumer insights offers both quantitative and qualitative data as well, but its focus is on explaining consumer behavior. It brings a deeper understanding of how your consumers think and feel. It can even reveal when they’re ready to take the purchasing plunge.

Consumer insights also guide you in every aspect of consumer relations, from online messaging to brand services and product ideation. Other benefits of consumer insights are:

For our purposes here, consumer insights are uncovered using analytics tools that collect and process data. These tools use artificial intelligence (AI) to dig deep into the language consumers use. And it reveals their habits, intentions, perceptions, desires, and needs.

Today’s artificial intelligence uses natural language processing (NLP) to derive consumer insights from the everyday language used online. Words and phrases are categorized and assigned sentiment values – -1 for negative and 1 for positive.

Using NLP, social listening tools give us a virtually unlimited data set of consumers expressing themselves on the web. Not only can we capture it, but we can also measure sentiment, which tells us how consumers feel about any topic.

For the uninitiated, robust social listening capabilities tell us much more about consumers than just sentiment measurements. NLP catches everything, including brand mentions, emotions, behaviors, and much more. It tells you what people are talking about and in relation to what. Check out the example below:

This type of text categorization is a game-changer for finding consumer insights fast. We can input any topic and comb the far reaches of the web to pull in every mention of it. It’s a draw-dropping capability in finding what consumers love, hate, need, and want.

Without social listening, we’d still have to rely on interviews, surveys, and focus groups. The consumer data on the web would still exist, but it would be impossible to gather concrete evidence from it. And this is why brands are clamoring to get in on the action.

Consumers are complex, so every bit of information you can get to help decipher their different attributes allows you to shape more relevant messaging. And it helps you to identify people on the fringes of your audience, which you target to draw them into the fold.

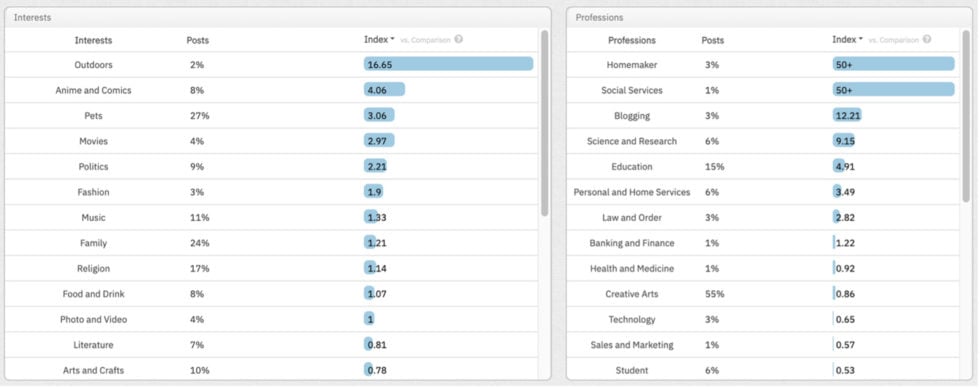

And consumer insights are great for brainstorming marketing ideas. It’s possible to isolate your custom audience and dig through their attributes to discover unique messaging ideas. In this example, we have narrowed down an audience composed of millennial pet owners and filtered for their mentions of interests and professions.

What’s interesting is that 55% of people in this conversation are creatives. Aside from the obvious interest in pets – arts & crafts, literature, music, and anime are some of the other leisure activities within the audience that stand out. From a marketing perspective, can we craft a video or social media post that targets these people directly? Yes, we can.

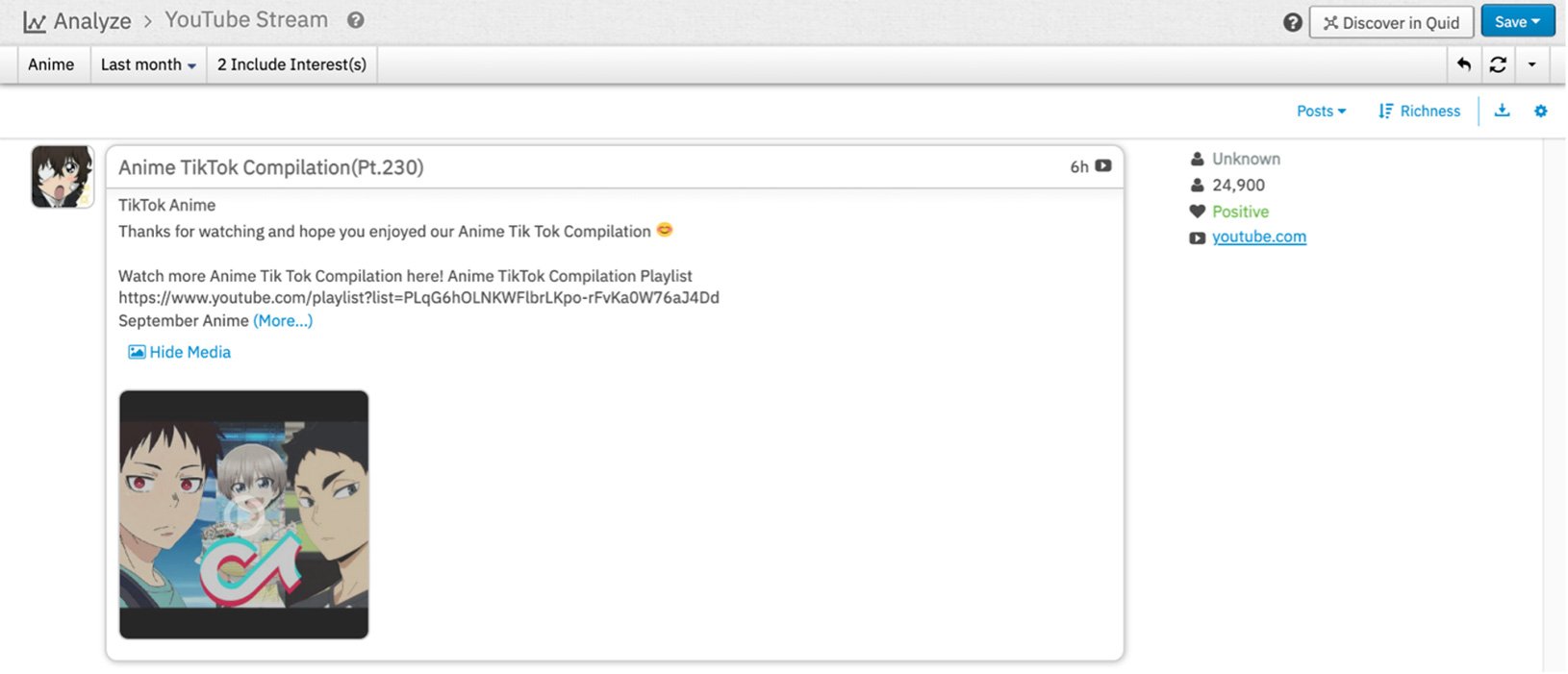

And we don’t just throw up a pet-themed anime on YouTube and hope for the best. Social listening allows us to isolate this further to include only creatives interested in anime. This will tell us the channels and domains they frequent and the top authors in the space. This intel will allow us to get familiar with what type of content they are drawn to.

Additionally, consumer insights reveal top trending hashtags, which we would then implement in our own campaign. Continuing with our pet-friendly anime as an example, we’ll start with video, since after all, it’s currently king. As such, our social listening will also compile the anime videos from across YouTube and social media that your target audience is engaged with. So, when you hit upon the anime TikTok compilation, it opens many opportunities for your messaging.

If you’re selling Cat Wow cat food, a TikTok stitch with a popular anime segment would be the perfect opportunity to test your messaging in the space. You know it’s relevant to your audience, short-form video is all the rage, and you could set one up with minimal effort. This is deep into the heart of the voice of the customer and playing off these types of consumer insights lets your audience know that you’re paying attention.

Of course, this is just one example of where your consumer insights can lead your marketing efforts. And it’s entirely possible that just referencing an anime character in your posts that’s popular with a portion of your audience would be enough to endear them to your brand. Regardless, it’s undoubtedly a rabbit hole your brand would have never explored without digging deep into the interests of your audience.

The end goal of consumer research is to create a deeper understanding of your target audience. You want to know what they care about and what influences them to make purchasing decisions. This depth of focus allows you to target them with more personalized and relevant brand experiences.

Using social listening to uncover consumer insights allows you to:

These consumer insights offer guidance and clarity in your campaign-building strategies. Knowing precisely who your custom audience is and what moves them, you can avoid messaging that misses the mark. And monitoring the social climate surrounding your audience over time ensures you’re keeping track of issues and needs as they arise.

There are many angles that marketers can focus on to boost perception around their brand, products and tie themselves to emerging trends. Monitoring the circumstances surrounding your brand is how you know where your standard is so you can get to work on your messaging strategy when the situation calls for it. Let’s look at some of these angles marketers use to target areas of need.

How consumers perceive your brand means everything. Using social listening tools to measure your brand sentiment is one of the best things you can do to safeguard your brand’s future. Establishing baseline metrics you’d like to keep track of illuminates areas of strength and where your brand needs a boost.

As such, social listening provides a hierarchy of concerns that you can approach, starting with the most pressing issues. And since you can break down any topic to the smallest detail, you’ll know exactly where the problem lies. Savvy marketers use these brand health insights to craft messaging that fortifies areas of weakness.

For instance, if social media users complain about your customer service response time, you can work directly with that department to address the issue as they put new protocols in place. And you can put the message out on whichever platform these consumers are using the most and use influencers that already have your consumers’ ear. Social listening-based consumer insights will inform you every step of the way.

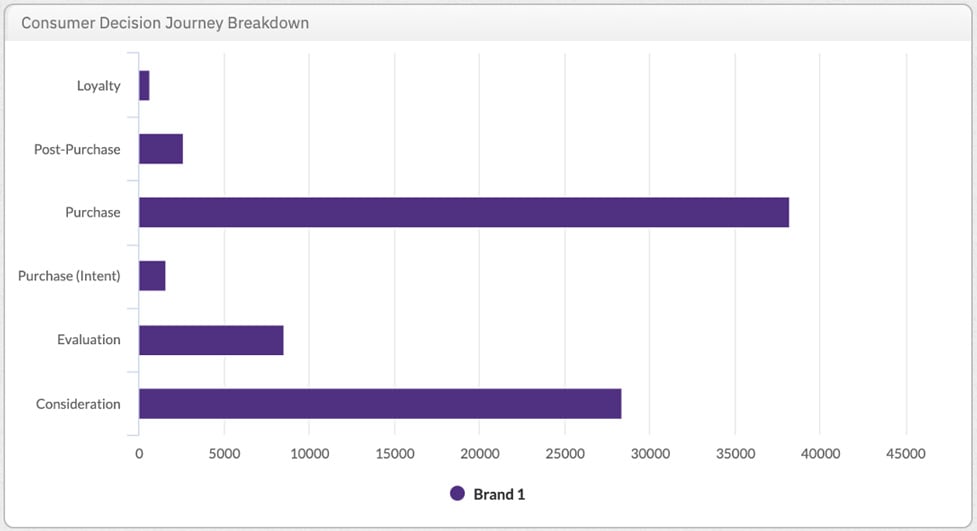

There are many avenues to pursue in understanding your consumers. On a broad level, social listening helps uncover areas of conversation pertaining to your brand’s needs. For instance, social listening provides the ability to segment your audience by the customer journey or a customer care analysis to filter for these narratives from within your brand mentions.

A customer journey analysis helps marketing teams build brand awareness, understand consumer behavior, and build demand throughout the purchase funnel.

You can develop a rich understanding of how your consumers engage with your products by examining social conversations centered around consideration, evaluation, purchase intent, purchase narratives, post-purchase, and loyalty.

Today’s social listening tools allow you to isolate your target audience within any topic. Marketers use this capability to find how their audience responds to new products, current events, and emerging trends.

This is done by finding your most vocal brand proponents and digging into their attributes down to a cellular level. AI captures much more than just words and gives us valuable consumer insights such as where they are talking and with whom.

It also gives us timestamps, languages, popular posts/media, sentiment, sentiment drivers, tags, GPS locations, in addition to demographics. Additionally, top tools can capture psychographic data as well, giving us valuable consumer insight into beliefs, emotions, lifestyles, and interests. This type of granular audience analysis helps marketers craft precise messaging for any situation and target these audiences directly.

Social media monitoring is a godsend for PR and communications professionals. Keeping tabs on your brand health metrics will alert you immediately when the social climate around your brand takes a turn for the worse.

Marketers can set alerts around brand health metrics to know why sentiment is heading into the red and where people are talking. It’s all about speed so you can get your message in front of eyeballs before the situation spirals out of control. There are always two sides to every story, and you need to get yours out quick before a portion of your audience writes you off for good. Using consumer insights for crisis analysis can save the day – and your brand’s hard-won reputation.

Social listening allows marketers to analyze past product launches using historical data to understand high points and where things could use improvement. Additionally, competitive product analysis helps marketing teams see a competitor’s product reception to use those consumer insights in their campaign strategy as well.

Knowing where these conversations got traction is instrumental, so you know where to focus your efforts. And shaping your audience targeting lets you hit the sweet spot with your audience – as well as consumers in the consideration phase of a competitor’s product.

Tracking consumer chatter throughout your campaign lets you adjust on the fly. If you start picking up traction with consumers on the fringe of your audience, then you can adjust your targeting to increase their engagement. Additionally, if your Instagram audience is yawning while TikTok is exploding, you know to cut your losses and go all-in where your customers are.

Monitoring the metrics around your campaigns acts as a scorecard you can use for future campaigns. This is especially helpful in campaigns you run every year. And it’s much more than platform-specific metrics. Social listening tools provide consumer insights that act as feedback from across the web. It’s invaluable to sharpen your campaign performance since you’re operating from a holistic viewpoint.

The way that consumers evaluate and engage brands is rapidly changing. For this reason, brands need to understand and listen as consumers openly share their honest opinions on social media. These opinions can become valuable consumer insights and help provide direction for brand strategy.

Social listening tools monitor the social web for what is being said about a company, product, or trend across all social channels. As such, they offer a window into consumer conversations that inform your business, crisis response, campaign measurement, content ideation, product launches, and more.

Quid collects from over 300 million sources in real-time and funnels this data through an NLP engine. This process parses out over 42 languages and categorizes posts by emotions, behaviors, and other filters, allowing you to uncover deeper consumer insights. Data is stored in a data warehouse and provides up to 27 months of historical data.

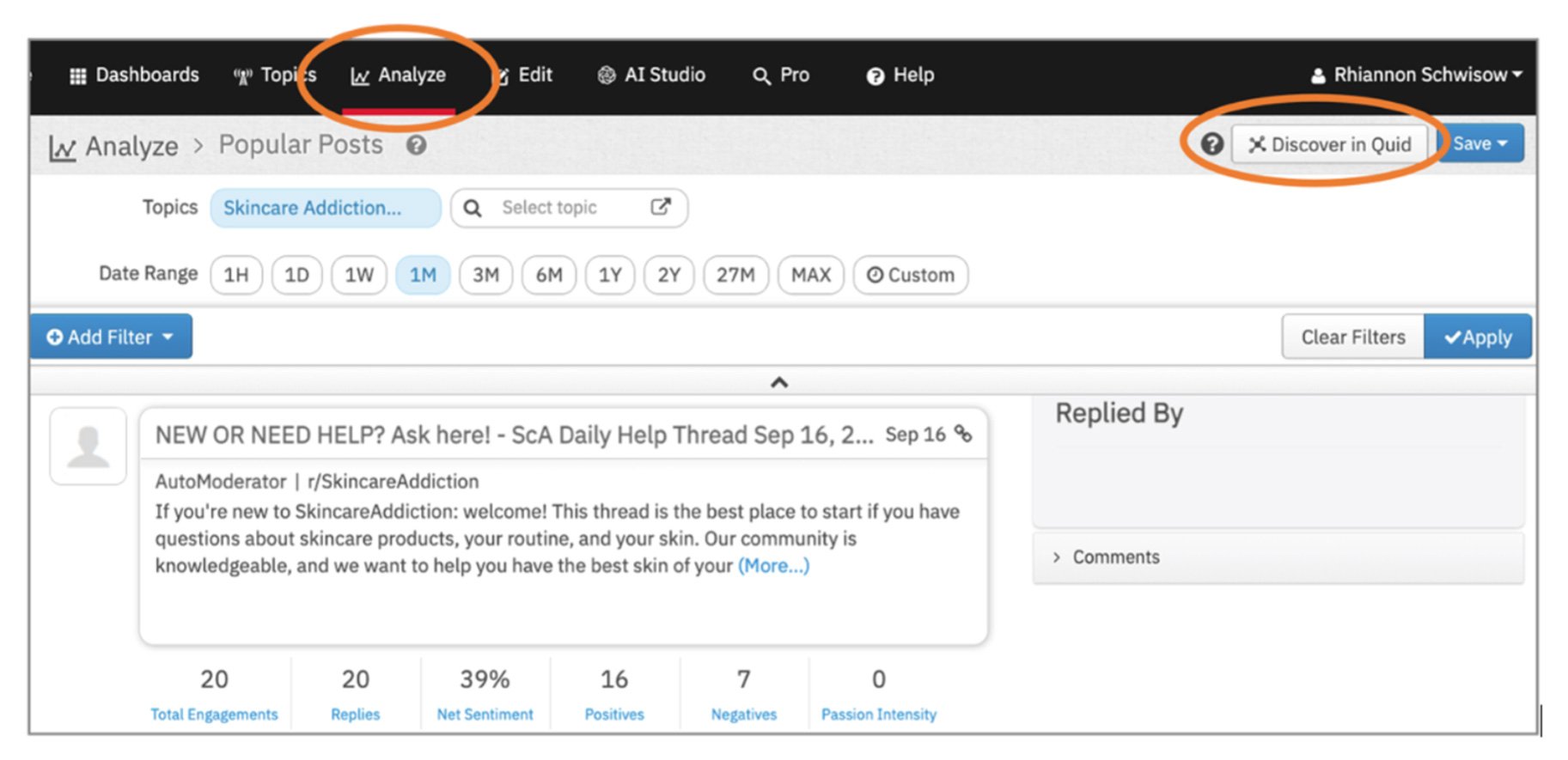

Discover detailed metrics around any topic in minutes for a quick overview of the structure of the conversation. And every metric offers complete transparency, meaning you can drill down to the posts behind the numbers, so you’re confident in the data you present to your decision-makers.

Additionally, the ‘Discover in Quid’ function gives you the flexibility to open any analysis directly in Quid Social. This feature seamlessly prepares your topic for impactful data visualizations, including network maps, timelines, scatterplots, histograms, and bar charts. There’s never been an easier way to find and share your consumer insight data.

Quid offers speed along with transparent accuracy that’s unparalleled in the industry. At the speed of social media, marketers require tools that get them to the heart of the matter quickly. No matter the situation, Quid will put dynamic consumer insights at your fingertips, putting you on the path to unprecedented marketing success and ROI. Reach out for a demo – we’d be happy to walk you through the tools so you can see for yourself!